Jeffries calls on Trump to reverse student loan interest restart

With interest set to resume for SAVE plan borrowers on August 1, the top House Democrat says the Trump administration is making life even more expensive for working Americans.

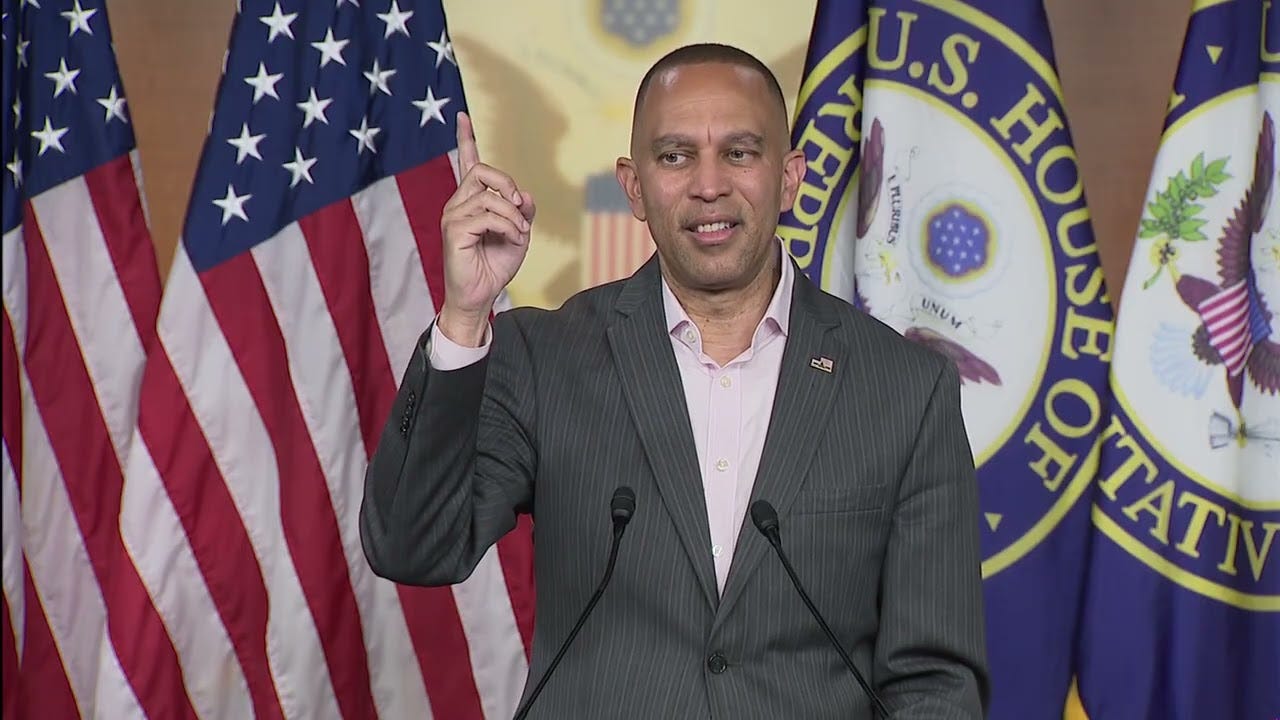

House Minority Leader Hakeem Jeffries (D-N.Y.) said the Trump administration should reverse its decision to lift a Biden-era pause on student loan interest payments set to expire at the end of the month.

The resumption of interest payments—particularly for borrowers enrolled in the Saving on a Valuable Education (SAVE) plan—could add another financial burden to many Americans already struggling with rising living costs, housing insecurity and economic uncertainty driven by President Donald Trump’s trade war.

Jeffries framed the move as part of a broader pattern of policy actions that have worsened the affordability crisis for everyday Americans.

“[This policy] represents an assault on students, just like we’ve seen the Trump administration assault veterans, assault homeowners, assault everyday Americans, assault small business owners and entrepreneurs and others,” he told Once Upon a Hill. “It’s just yet another example of the Trump administration not giving a damn about the high cost of living in the United States of America, and in fact, consistently doing the opposite as it relates to providing relief.”

Rep. Jahana Hayes (D-Conn.), who serves on the House Education and Workforce Committee, told me she agreed with Jeffries that the policy should be reversed and said that not doing so would lead to many people defaulting on their loans.

“The cost of everything is going up,” she added. “And now these payments are going back into effect when people are still not stabilized.”

The Education Department announced on July 9 that interest would begin accruing again next month for borrowers enrolled in the SAVE plan, following a federal court ruling and in line with the Trump administration’s broader implementation of the One Big Beautiful Bill Act.

Launched under the Biden administration after the Supreme Court struck down its original student debt cancellation plan, the SAVE plan became the most affordable income-driven repayment option. It capped monthly payments at 5% of discretionary income for many borrowers and included an interest subsidy that prevented balances from growing if borrowers made qualifying payments. Once interest resumes, this cushion will be gone and any shortfall in monthly payments will start compounding again, reversing years of progress for borrowers who were finally beginning to gain traction.

Estimates suggest that an average SAVE borrower could accrue $3,500 or more in additional annual interest without the subsidy. Many borrowers—especially Black, Latino and first-generation graduates—face renewed pressure to delay milestones such as buying a home, starting a family, or launching a business. The psychological weight of rising balances may also dampen political engagement or erode trust in institutions, especially if forgiveness options or safety nets continue to deteriorate.

The interest pause will occur weeks after Republicans pass their megabill. It makes sweeping changes to the federal higher education system that critics warn will drive up costs for current and future borrowers. The law eliminates key tax credits for students and families, imposes new borrowing caps for graduate and professional students and ends both Grad PLUS and Parent PLUS loans.

It also grants the Education Department broad authority to restructure income-driven repayment plans—potentially reducing forgiveness options—and makes it more difficult for borrowers who have been defrauded to obtain relief. Though the bill expands Pell Grants to include short-term workforce programs, the overall shift tilts away from affordability just as many borrowers are still regaining their financial footing after the pandemic.

The Education Department confirmed in a letter last week that it will move forward with key higher education provisions from megabill. While the department emphasized steps to avoid mid-year Pell Grant cuts and outlined upcoming eligibility changes for workforce training programs, the letter also signaled the administration’s intent to begin phasing out critical borrower protections, such as the gainful employment rule. For many, the message was clear: Even as inflation persists and economic volatility grows, the policy focus shifts away from affordability and toward cost containment, leaving borrowers to bear the brunt of the difference.

Heading into the midterms, Jeffries said House Democrats’ focus would remain on building an affordable economy.

“Imagine an America where when you work hard and play by the rules, everyone can afford to live the good life. That’s the America that House Democrats are working hard to bring about: good-paying jobs, good housing, good health care, good education for your children and a good retirement,” he said. “But our system is broken, and Republicans are making it worse.”

A White House spokesperson did not respond to a request for comment.